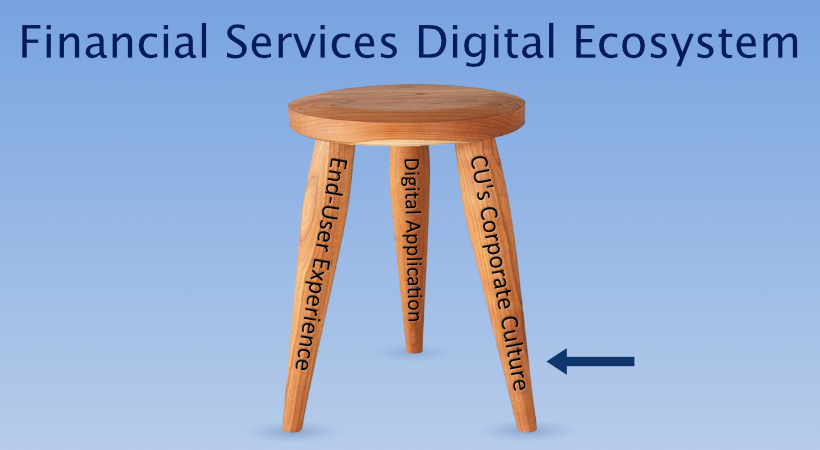

At Connect, we believe several components create a successful digital banking experience for you and your members. Consider the financial services digital ecosystem as a three-legged stool. Each leg on the stool is of equal importance to maintain the balance of the ecosystem. The first leg of the stool is the digital application. The second leg of the stool is the end-user experience. The third leg of the stool is the credit union’s corporate culture.

Out of the three legs, the one that often throws the ecosystem out of balance is the credit union’s corporate culture. More specifically, does the culture reinforce a digital-first strategy? After COVID-19, many financial institutions have prioritized the development or redesign of their digital banking platform. While a well-designed digital application can assist the organization in meeting its digital-first goal, the last mile (the distance between the potential end-user and the application) is often overlooked. Credit unions primarily rely on marketing campaigns for that last mile, but the resource that the members trust most often is overlooked.

That resource is the staff itself, and the personal recommendations that they can offer to members. The organizational culture and its employees must support and believe in a digital-first strategy. The components that create and support a digital-first strategy are training, measures of success, and staff who use the digital application.

Employee Training

Understanding digital products is different than having product knowledge about traditional financial products/services. Credit union staff (both seasoned and new) understand products like checking, savings, ATM, debit card, etc. Those products have been around forever, and the cross-sell "queues" that employees use to sell those types of products/services are well established. Also, credit union employees know how to interact with members in a physical branch and call center.

But what about selling products and services in the digital channel? Credit union training programs often offer "branch selling simulations" in the training room, but how many include online and mobile selling situations as part of the training program? Does your training program include a brainstorming session and group presentation on how the credit union's digital products and services could be sold online?

Consultative selling can be accomplished in any channel. Still, the sales staff need to understand the channel, recognize the sales queues in the channel, and how the products and features in the channel interact. It is vital to ensure that existing and potential credit union staff can effectively function within the digital channel. The critical point here is that familiarity with the digital channel and the ability to sell within the channel are prerequisites for a digital-first strategy.

Measures of Success

What metrics is your credit union using to measure a thriving digital-first culture? Products per household, length of membership, and average daily balance are necessary fundamental measures of success. Employee cross-sell ratio is also an important metric to measure. Credit union often cite new digital banking registrations as a vital cross-sell metric, and part of the employee cross-sell ratio, but are they?

Isn't a digital banking registration with no use synonymous with the cross-sold checking account that never has any activity or balance? If we take it one step past digital enrollment, how often does the user interact with the digital channel? How many additional digital products and services has the user enabled since enrolling?

Potential success metrics for the digital channel are how many monthly logins, the length of stay in the application per session, and the number of digital products and services actively used. A digital user who logs in to look at their account once or twice a month and uses no other digital products and services is probably using those services elsewhere. A digital channel success metric that stops at new user registration limits the digital-first strategy of the credit union.

Employee Digital Channel Usage

We have saved perhaps the most crucial component for last. Do your employees have their paycheck direct deposited into another financial institution? What does that say about the value the employee places on your products and services? And, without any account relationship with you, how can they effectively cross-sell products and services? They cannot sell something that they do not use. How could an employee who does not your digital application or any of the products or services within it effectively cross-sell or provide service to a digital user?

There is a difference between reciting the product features of the digital application and knowing how they interact with one another. How can an employee cross-sell or explain the digital channel if they have never used your online or mobile banking applications? Statements such as "I find it useful to..." or "This digital product will enhance the value of your digital experience…" are impossible unless the employee is actively engaged with the digital channel as a user. And on the service side, how does an employee assist in a channel in which they have no experience? An employee that is immersed in the digital experience can provide valuable product feedback as well.

The key to consultative selling is familiarity with the products and services being sold. As stated earlier, your credit union is probably immersed in refining or redesigning your digital channel. Employees need to be active users to be able to effectively sell digital products and services to your potential and existing digital users.

Pulling it all Together

Does your organization have a digital-first strategy? Does that strategy employ digital training, digital success metrics, and staff who use your digital channel?

- An employee who has not been trained on the digital channel or how to sell the digital products and services cannot support a digital-first strategy.

- Success metrics that measure digital product success on enrollment, without measuring use of additional digital products, inhibit the growth of a digital-first strategy.

- Finally, employees who are not active users of the digital channel cannot relate to or understand the needs of your digital users. Being consultative requires both product knowledge and user experience.

While the digital channel design is a critical component to attract and retain members, the organization's culture and employee expectations largely determine the "last mile" fulfillment of your digital-first strategy.